PBMs Continue to Block Patient Access to Lower-Priced Biosimilar Insulin

As policymakers continue to discuss ways to lower the cost of medicines for patients, the role of pharmacy benefit managers (PBMs) in blocking patient access to lower-priced generics and biosimilars remains front and center. Last month, we reported on the slow crawl of Humira biosimilar adoption and the deeply rooted barriers lower-cost medicines face in overcoming PBM pricing and rebating practices that continue to drive reliance on brand products. The analysis, conducted by Avalere Health on behalf of the Biosimilars Council, found that across the five largest Medicare Part D parent organizations in 2023 (United Healthcare, Humana, CVS, Centene, and Cigna) biosimilars are substantially less likely to be covered than their reference products. More specifically, while brand Humira is covered 99% of the time by these MA-PD and PDP plans, lower-priced biosimilars are only covered 6% of the time. (The full analysis is available here)

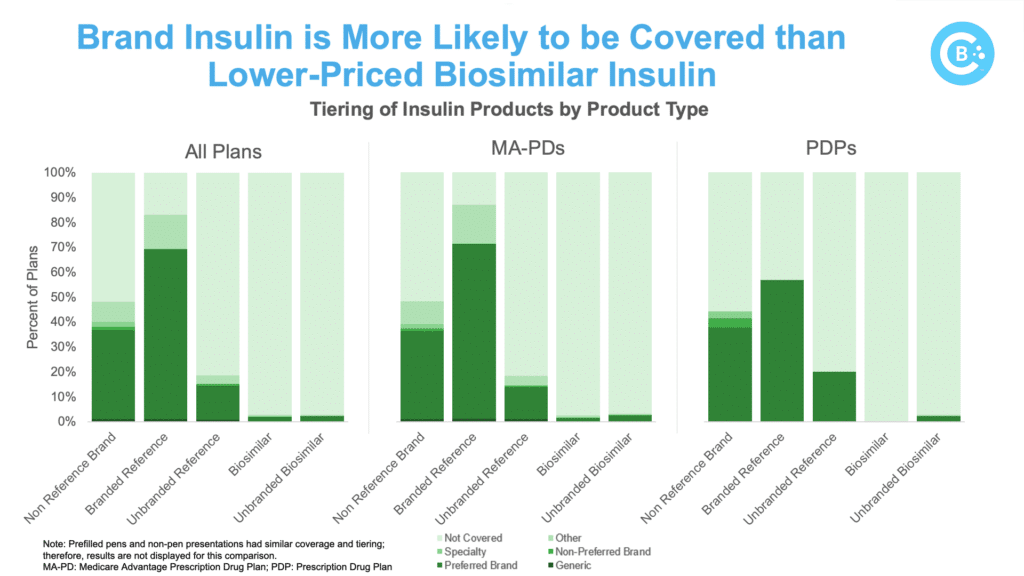

The analysis reiterates that biosimilar challenges are not limited to the Humira market. PBM formulary controls significantly restrict access to biosimilar insulin in Medicare, with the five major payers offering better coverage for the brand while blocking or limiting coverage for the lower-cost biosimilar.

This overall trend favoring brand insulin is clear: the biosimilar was covered by Part D plans only 5% of the time. The results among Medicare Advantage plans were even worse, with biosimilars being covered only 3% of the time. Specific product-level results show:

Insulin glargine biosimilars (Rezvoglar, Semglee) are less likely to be covered than their reference product (Lantus).

- Brand insulin Lantus is covered 83% of the time while biosimilar insulin glargine is only covered 3% of the time.

Lantus is more likely to have open access compared to biosimilar insulin glargine.

- Brand insulin Lantus has open access 83% of the time while biosimilar insulin glargine has open access only 2% of the time.

This updated report on coverage and utilization management practices by PBMs is consistent with previous analysis conduct by the Biosimilars Council and IQVIA, which found widespread formulary blocks denied patient access to biosimilar insulin. This highlights concerns about PBM decision-making prioritizing the value to payers over the well-being of patients and raises a fundamental question: if lower-cost alternatives are developed, but access is restricted, what is the true benefit?

As we’ve seen with both insulin and Humira, a thriving biosimilar market can improve healthcare access and affordability for many Americans. Eliminating incentives for higher-priced drugs and ensuring patient access to biosimilars are crucial steps towards realizing this potential.