The biosimilars market has reached a new milestone, with the first-ever biosimilar to Humira (adalimumab) recently launching, and as many as eight more expected later in 2023. This is the bestselling drug in the U.S., and the introduction of biosimilar competition represents a major expansion in patient access to treatment and savings. However, new research shows that stakeholders will need to be patient while the benefits of adalimumab biosimilars materialize.

The new report, “Near-Term Expectations for Adalimumab Biosimilars in the United States,” by Alex Brill and Christy Robinson of Matrix Global Advisors (MGA), details the realities of the adalimumab biosimilar market. The paper concludes: “Adalimumab biosimilars will achieve substantial savings, but stakeholders should recognize that 2023 will be just the beginning of a transition to a competitive market.” The authors note factors contributing to a relatively slow transition to a competitive market, including the time required for multiple biosimilars to launch, the market advantage that the reference product enjoys, and the fact that adalimumab is the first non-insulin biosimilar in the pharmacy benefit. The authors highlight the important differences between the medical benefit – which covers existing, provider-administered biosimilars – and the pharmacy benefit. In the latter, manufacturer rebates are commonly used to secure formulary placement. This means that net prices of pharmacy benefit drugs are unknown and list prices are uninformative. These dynamics caused the manufacturer of the first-to-launch adalimumab biosimilar to offer two different prices so that the medicine could reach patients.

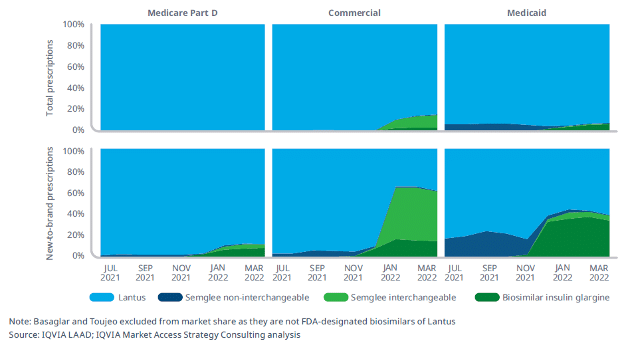

We’ve seen this before. As detailed in a recent IQVIA report, insulin biosimilar Semglee has two different prices, one with a slight decrease in price and high rebate, and another with a major (65%) decrease in price. Although the lower list price would have translated into lower costs to patients, PBMs adopted the higher priced version, or opted to stick with the brand version, rather than encouraging use of the lowest list price.

This practice of preferring medicines with high list prices and high rebates negatively impacts patients. As Adam Fein notes in Drug Channels: “Unfortunately, we should expect most PBMs and plan sponsors to embrace the high-list/high-rebate version. The plans that adopt the higher-priced biosimilar will get bigger rebates, while patients with coinsurance and deductibles end up paying more out-of-pocket.”

But the adalimumab biosimilars market will be affected by more than just rebates. Brill and Robinson highlight other factors contributing to a longer timeline for significant biosimilar adoption, including different strengths and delivery devices as well as the fact that there is a natural learning curve for providers and patients as biosimilars become available.

Ultimately, biosimilars will result in lower costs. But the MGA report rightly notes that it will take time to materialize. And because of the lack of transparency into drug rebates, it will be more difficult to identify the lower prices offered by biosimilars.

Fortunately, policymakers can take steps to encourage adoption of biosimilar adalimumabs and other lower-priced biosimilars. PBM coverage decisions, too often driven by preferences for high-priced high-rebated brands, represent a critical barrier to competition. Policymakers can ensure that patients receive the full value of lower prices from biosimilars by putting an end to policies that encourage preferences for higher list prices and high rebates. Common sense formulary designs that favor biosimilars are straightforward approaches that can ensure that patients, not PBMs, benefit from biosimilar competition.

About the Biosimilars Council

The Biosimilars Council, a division of the Association for Accessible Medicines (AAM), works to ensure a positive environment for patient access to biosimilar medicines. The Biosimilars Council is a leading source for information about the safety and efficacy of more affordable alternatives to costly brand biologic medicines. Areas of focus include public and health expert education, strategic partnerships, government affairs, legal affairs and regulatory policy. More information is available on our about page.

About AAM

AAM is driven by the belief that access to safe, quality, effective medicine has a tremendous impact on a person’s life and the world around them. Generic and biosimilar medicines improve people’s lives, improving society and the economy in turn. AAM represents the manufacturers and distributors of finished generic pharmaceuticals and biosimilars, manufacturers and distributors of bulk pharmaceutical chemicals, and suppliers of other goods and services to the generic industry. Generic pharmaceuticals are 90 percent of prescriptions dispensed in the U.S. but only 20 percent of total drug spending.