Tuesday January 30, 2024

Last year’s launch of the first biosimilar of Humira (adalimumab) signified a major opportunity to increase patient access to, and lower the costs of, one of the bestselling drugs in the U.S. A year later—and despite competition from 14 lower-cost, FDA approved biosimilar versions—it is disappointingly clear how many commercial, employer and government payers and their PBMs have been slow to adopt these medications. New research from the Biosimilars Council suggests that this slower-than-expected adoption may continue through 2024.

In February of 2023, the Biosimilars Council commissioned a report, “Near-Term Expectations for Adalimumab Biosimilars in the United States,” by Alex Brill and Christy Robinson of Matrix Global Advisors (MGA). The report recognized that barriers faced by previously introduced biosimilars, including opaque gross-to-net rebating strategies used by PBMs, would likely limit the initial competitiveness of Humira biosimilars. Unfortunately, this prediction proved prophetic. As the year ended, biosimilars had less than 2 percent of total adalimumab market share.

Why is this? Adam Fein, in a recent Drug Channels analysis, concluded “far too many of the PBMs’ plan sponsor clients—employers, health insurance plans, labor unions, governments, and other third-party payers—remain addicted to rebates. The plans that adopt the higher-priced biosimilars will get bigger rebates, while patients with coinsurance and deductibles end up paying more out-of-pocket.”

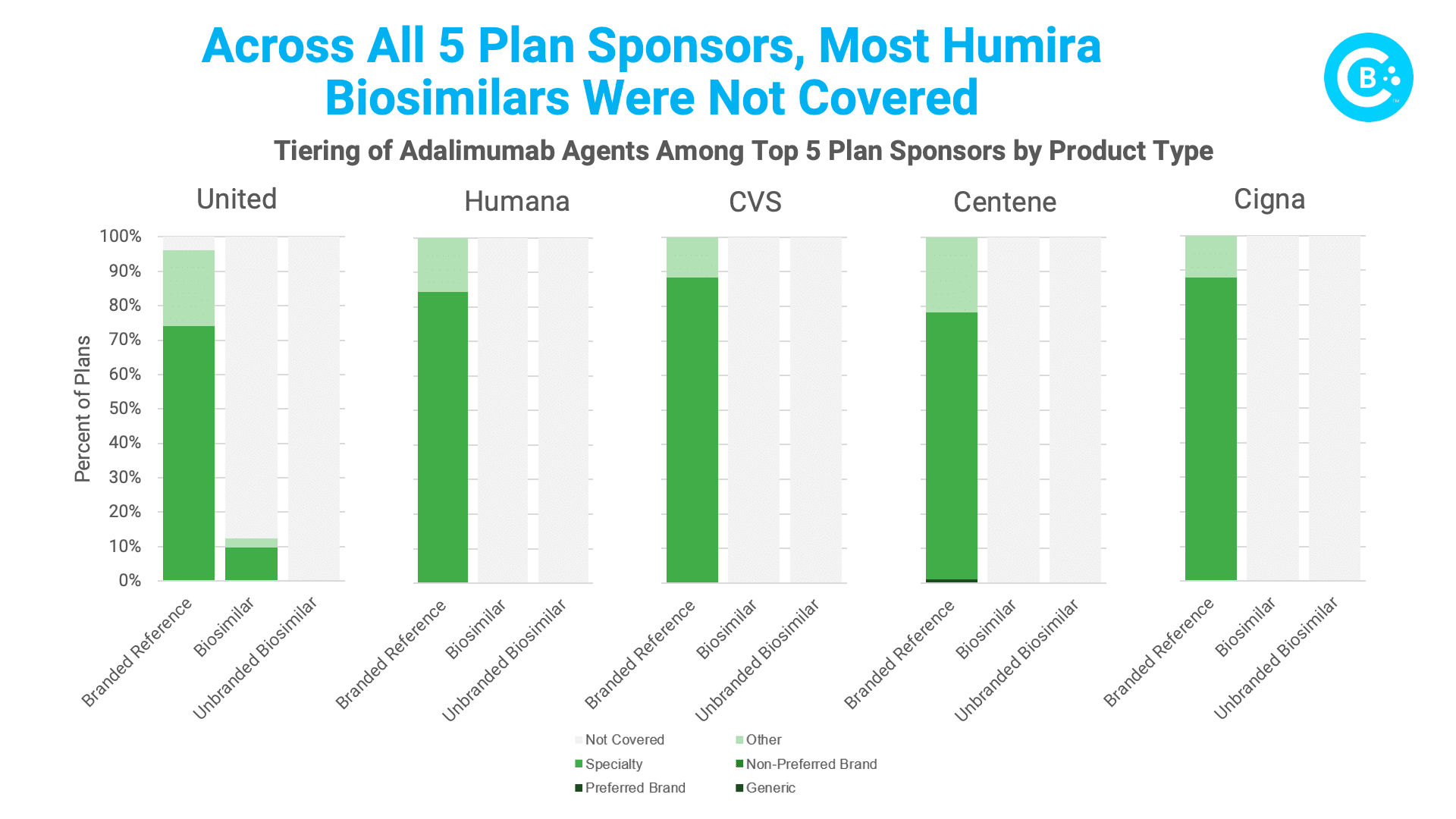

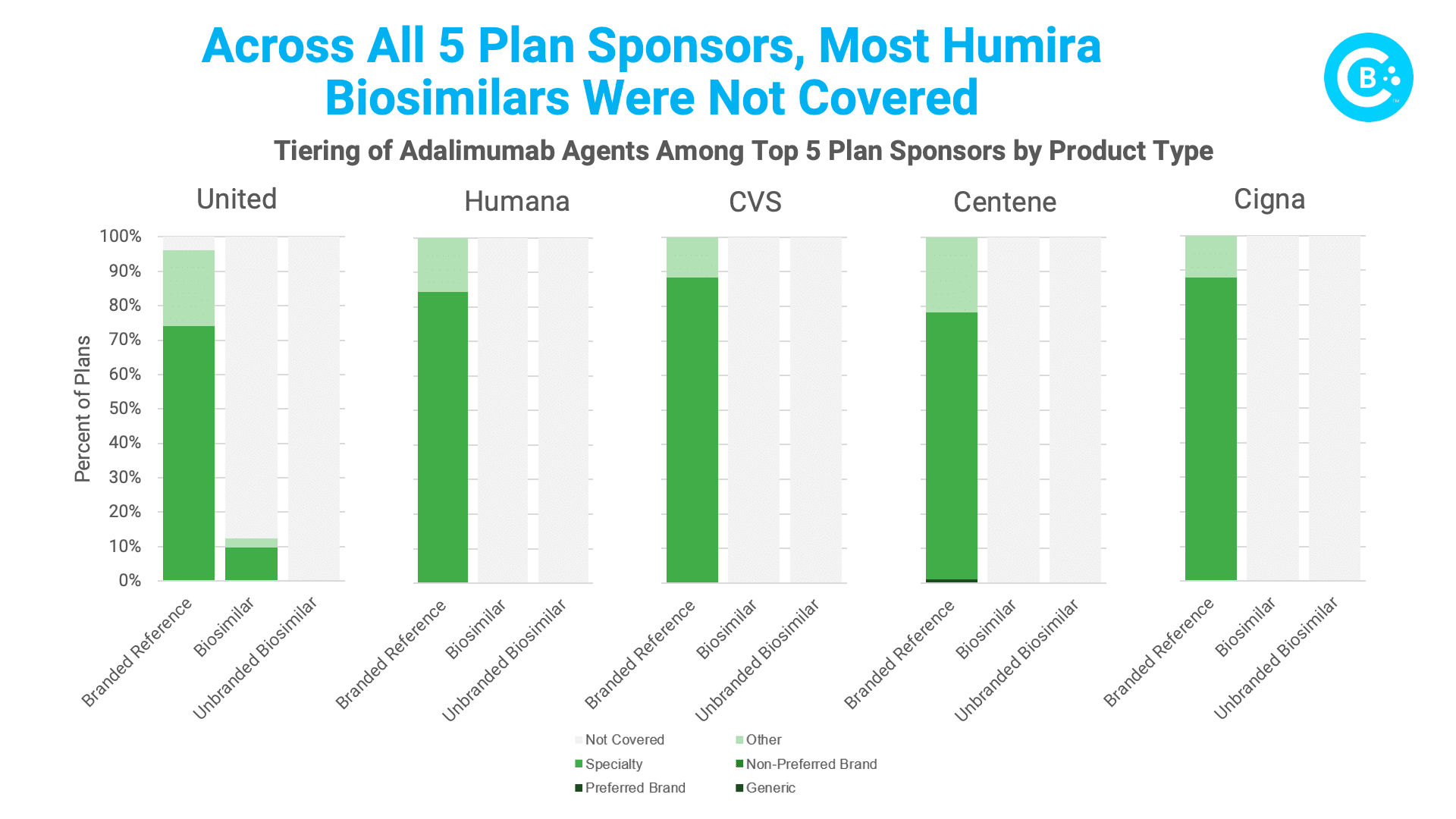

A new analysis conducted for the Biosimilars Council by Avalere further underscores the problem. Avalere assessed Humira biosimilar coverage across all plans, by plan type (MA-PD or PDP), and for the five largest Part D parent organizations in 2023 (United Healthcare, Humana, CVS, Centene, and Cigna). What did they find? Biosimilars are substantially less likely to be covered than their reference products. In fact, the brand Humira is covered 99% of the time, but lower-priced biosimilars are only covered 6% of the time.

The slow crawl of Humira biosimilar adoption stems from a tangled web of PBM pricing and rebating practices that combine to reward reliance on the brand product. Dislodging these deeply rooted barriers is no small feat. Biosimilars face an uphill battle despite having lower prices and no clinically meaningful differences. Policymakers must champion transparency, clear disclosure of net prices and rebates, and end the use of rebates and fees that are linked to list prices so that patients gain access to lower cost biosimilars. Formulary reforms can level the playing field by prioritizing biosimilars in coverage decisions and by nudging PBMs towards patient-centric choices.

With decisive action and a commitment to transparency, we can untangle these knots and usher in an era where cost-effective biosimilars truly empower heath care providers, and more importantly, empower patients and transform the landscape of chronic disease treatment. After all, affordable access to life-changing medications shouldn’t be a waiting game.